www.ceyron.io will be a cryptoculture-based investment platform with a cryptocurrency trading platform with debit capacities and pledges under active credit guarantee.

Ceyron Token has ...Ceyron

Token is something that can be used instead of money. CEY Tokens has digital tokens that will be issued to the investor (s) and represent beneficial ownership interests in a separate class of non-voting equity shares in Ceyron. CEY Tokens has functional utility smart contracts within the Fund. CEY Tokens are non-refundable. That's not for speculative investment.

Ceyron Finance Sarl (CFS) is a Limited Liability Company incorporated under the Limited Liability Companies Law (the "Fund") and is wholly owned by Ceyron Finance Ltd. CFL and the Fund have entered into a Operating Agreement setting out the rights and obligations of each party.

The Fund will be managed and advised by Colombus Investment Management Ltd (the "Fund Manager"). Colombus Investment Management Ltd is a British Virgin Islands registered as an independent alternative investment management company specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Fund's operations and will perform all services and activities related to the management of the assets, liabilities and operations of the Fund.

Investment Objective and Strategy

The Fund's investment objective is to provide an attractive return on investment capital through a proprietary quantitative approach to underwriting credit assets provided by Colombus Investment Management Ltd. The Fund will adhere to an investment strategy driven by data science, non-parametric statistical models are applied to the problem of expected gains in financial investments.

The net income earned by the Fund during any given month shall be retained for reinvestment, but a portion of the potential periodic earnings may be used to distribute annually dividends to CEY Token holders, where such dividends are approved by CFL's board and voting shareholders.

Credit Portfolio Backed Token to Provide Less Volatility and More Cash Flow

The portfolio of credit assets will be further secured by a surety wrap to enhance stability and returns. The Fund Manager will use artificial intelligence and machine learning to build a portfolio of secured credit assets.

Blockchain Technology Enables Efficient Liquidity for Investors

Blockchain technology has the potential to provide greater integrity, safety, security, and transparency. As such, CFL will use the block to ensure immediate transaction adjudication at low cost in the hope of providing greater liquidity for investors.

Efficient Prepaid Debit Cards

The account holders will be empowered to select from multiple cryptocurrencies for use as tender, and when they initiate a transaction (eg a dinner that costs $ 83.65), either prepaid debit cash will be used, or the holder can choose to use a supported cryptocurrency, which will then be sold at the spot price to complete the transaction.

Competitive Fees

Since CFL will hold both cash and an array of cryptocurrencies at all times, it will be able to facilitate seamless exchange of cash in cryptocurrency to facilitate transactions and will enable CFL to compete with Coinbase on both service and fees.

CFL is Launching into a Growing Market

The market for cryptocurrencies has grown by more than one hundred and sixty billion USD ($ 160,000,000,000) in the past year. Financial giants and Central Banks have invested in blockchain technology. Both large and small investors are looking for a more regulated market that provides security coverage and insurance coverage in any registered security market.

Problem Statement for the Developing World

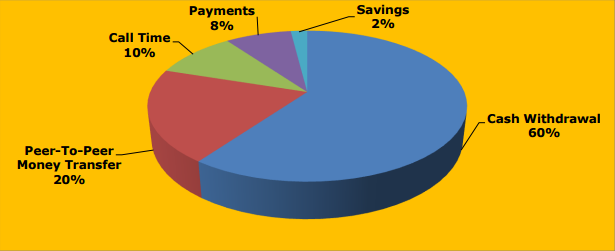

The population of the developing world (South East Asia, Latin America and Africa) accounts for over 2 billion people. Africa alone represents 1.2 billion people. It is young and dynamic: 60% are under 50 years of age.

Banks are progressively adopting mobile banking to:

1) develop online banking services;

2) Take digital benefits to parties to integrate millions of people into the formal financial sector;

3) Develop merchant payment services.

Low banking rate

According to experts, more than 2.5 billion people with low-income and / or middle-income are not linked to a bank. The traditional agency model easily meets the needs of the poorest but does not fully meet the requirements of banks.

The reasons for low banking penetration are at two levels.

1. At client level: most people have low or very low income, and thus low savings capacity. While monetization of the economy has increased significantly since the 2000s, the use of a bank is not yet part of the spontaneous practices. The emergence and rapid growth of very strong microfinancing companies are radically changing this situation.

2. At the bank level: the relative excess liquidity of banks is not an incentive for the development of customers. The low population density adds the average cost of implementing agencies.

Highly competitive market

More than 75% of countries have the majors

CEY token holders will have the privilege to receive their annual dividend on their CFL card.

Lack of secure and non secure credit for credit applicants

CFL has the intention to solve the problem in Africa where there is a lack of credit available for most applicants. More specifically, the dividends distributed to CEY token holders will enable them to be eligible for credit because the dividends could be considered as one source of income.

In Africa, there is a lack of steady and sustainable income when it comes to credit applications.

CFL'S Solution

CFL Credit Portfolio

Today, sixty percent (60%) of the U.S. mortgage credits are held by non-banks, up from thirty percent (30%) in 2013. Over four trillion USD ($ 4T) in the U.S. mortgages alone are available to choose from hundreds of non-bank credit platforms. The Fund Manager is tasked with approving the solvency and risk associated with their own platforms and identifying the credit profiles of originated assets, from regulatory compliance to origination, volume, collateral, duration, and quality to management and servicing. The Fund Manager will be tasked with selecting the highest performing assets available in these CFL portfolio platforms as well as purging the highest risk assets from the CFL portfolio.

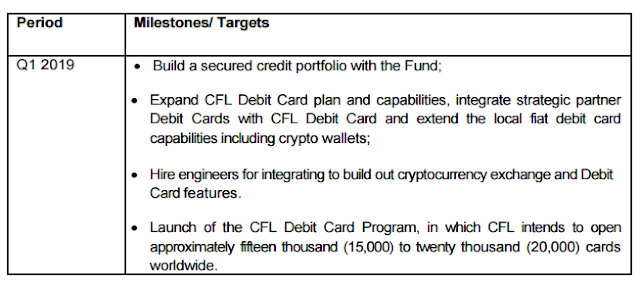

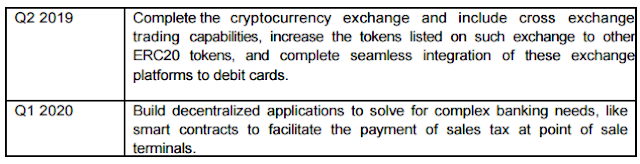

Investment Roadmap

CEY Card

The CEY Card will be a physical, virtual, and debit MasterCard with a mobile application that will allow for the use of twenty (20) foreign currencies from a single card. CFL may save customers up to 70% (70%) on these fees. The average price is 3.75% versus 3% for CFL, and also through an app. Additionally, unlike the standard one and a half percent (1.5%) fee for ATM withdrawals, CFL will assess no fee for ATM withdrawals. The CFL mobile application will contain additional functionality to transfer funds in any currency between merchants, as well as friends and family accounts, resulting in a zero percent (0%) money transfer fee.

The CFL Card plans to have a Partner for Expense Management. This will allow integration from a mobile application to facilitate management of travel itineraries and links to many travel partners for e-receipt management. In summation, the CFL card will be developed to provide increased liquidity in any of the twenty (20) global currencies as well as leading crypto currencies.

CFL and the Blockchain

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, to control the creation of additional assets, and to verify the transfer of assets.

Cryptocurrency was designed as a method for decentralized transactions with value held in scarce digital goods. It appeals most strongly to societies where governments have made their currency worthless through hyper-inflation. Today, fifty percent (50%) of people globally have bank accounts. In 2014, it was sixty-two percent (62%), and cryptocurrencies are taking more footholds among the unbanked. Cryptocurrency was designed as a method for decentralized transactions with value held in scarce digital goods. It appeals most strongly to societies where governments have made their currency worthless through hyper-inflation. Today, fifty percent (50%) of people globally have bank accounts. In 2014, it was sixty-two percent (62%), and cryptocurrencies are taking more footholds among the unbanked.

The market for fiat currency to cryptocurrency has only been operational for a few years. Illustrative of the current level of maturity of the industry are the relatively large differences between the prices in the fiat currency of Bitcoin on the various major exchanges.

Blockchain technology is still young, but it has already proved its capability as an immutable ledger. Bitcoin is a purely speculative token, and its value, much like diamonds or gold, outside of industrial uses, is entirely driven by scarcity and the guarantee for the holder that this good is unique and ready for transaction

CFL Security Token

CFL intends to provide, but does not guarantee, token holders with an annual dividend, which must be approved by the Board of Directors and holders of voting shares.

CFL intends to invest eighty-five percent (85%) of the proceeds received by CFL from this Offering in the Fund, and the Fund will invest in credit assets, thus seeking to create a stable, growing cash flow yielding base for CEY Token (Cash flow yields can not be guaranteed and may be impaired by both market and regulatory conditions)

CFL intends to use modest leverage to further enhance its returns from its credit portfolio to facilitate ongoing and continued reinvestment of the credit portfolio underpinning CEY Tokens (Enhanced returns can not be guaranteed and may be impaired by both market and regulatory conditions)

CFL will enhance its ability to establish its credit portfolio with leverage by providing its warehouse creditor and credit guarantee bond.

CFL intends to maintain a cash, securities and token reserve at all times to ensure liquidity for CEY Token holders (Liquidity of assets can not be guaranteed and may be impaired by both market and regulatory conditions).

CFL will enter into alliances with surety wrap providers that will be used to mitigate the risk of total capital loss. However, the use of these financial instruments does not constitute a guarantee against any and all eventualities.

Strategic Alliances

CFL's strategic alliances are established leaders in the field of blockchain technology, finance, and banking. CFL intends to enter into a service agreement with Coinfirm.io regarding KYC / AML (Anti Money Laundering) checks for each token holder application. Ambisafe is a pioneer blockchain technology and ICO offering company helping the world become more decentralized since 2010Their work has been critical on projects such as Tether and Bitfinex. More recently, Ambisafe is behind such ICO successes as. Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines.

Market Plan

The offer of CEY Tokens in Saint Vincent & The Grenadines is based on the exemption under the Securities Act. The CEY Tokens offered here (and the corresponding non-voting shares in CFL Ltd. held by the Nominee) shall not be subsequently sold to any person under any other offer in Saint Vincent & The Grenadines unless the provisions of the FSA are complied with.

CFL will be providing an Offer Memorandum that will be prepared by CFL's prospective investors in CFL. The Offer Memorandum will be prepared in conjunction with a private offering to accredited investors, individuals who will be required to verify their accredited investor status through a questionnaire and other necessary documentation, and other individuals globally who meet the requirements for participating in the jurisdiction in which they reside.

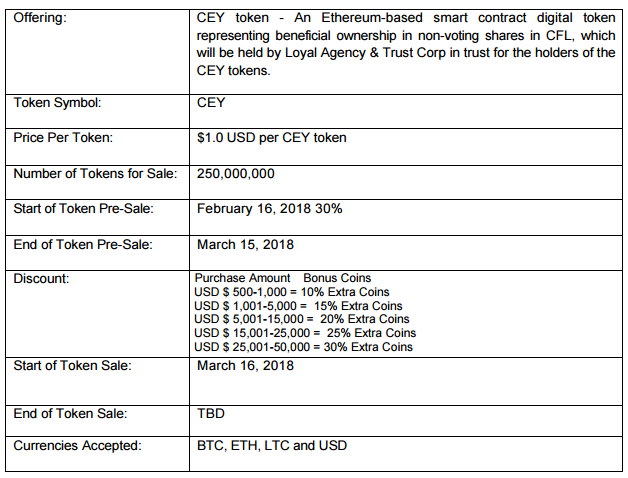

Summary of the Offering

Potential investors will be asked to personally identify information upon creating an account on ceyron.io to participate in the sale. This information is to ensure compliance with the various securities laws of the United States and foreign jurisdictions, as well as the Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

For United States investors, they must satisfy the obligations promulgated under the "accredited investor" standard pursuant to Regulation D, Section 506 (c) of the Securities Act. An investor can demonstrate that they qualify as an accredited investor by substantiating and uploading documents on ceyron.io as outlined in the following section "Participation in the Offering."

Participation in the Offering

This offer for prospective United States investors is limited to accredited investors as defined in Regulation D under the Securities Act, meaning only those persons or entities coming into one or more of the following categories:

Any bank, as defined in Section 3 (a) (2) of the Securities Act, or any savings and loan association or other institution defined in Section 3 (a) (5) (A) of the Securities Act, whether acting in its individual or fiduciary capacity; any broker-dealer registered pursuant to Section 15 of the Exchange Act; any insurance company, as defined in Section 2 (13) of the Securities Act; any investment company registered under the Investment Company Act of 1940 or a business development company, as defined in Section 2 (a) (48) of that Act; any Small Business Investment Company licensed by the United States Small Business Administration under Section 301 (c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political subdivision or any agency or instrumentality of a state or its political subdivisions for the benefit of its employees, if such plan has total assets over five million USD ($ 5,000,000); and any employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a fiduciary plan, as defined in Section 3 (21) of that Act, that is either a bank, savings and loan if the employee benefit plan has total assets in excess of five million USD ($ 5,000,000) or, if a self-directed plan, with investment decisions made solely by the person (s) that are accredited investor s);

Any private business development company as defined in Section 202 (a) (22) of the Investment Advisors Act of 1940;

Any organization described in Section 501 (c) (3) of the Internal Revenue Code of 1986, as amended, any Corporation, Massachusetts or similar business trust, or a company not formed for the specific purpose of acquiring the Common Stock, with total assets in excess of five million USD ($ 5,000,000);

Any director or executive officer of the Company;

Any natural person whose net asset value or common net worth with that person's surname, excluding the value of his / her primary residence net of any mortgage debt and other liens, at the time of his purchase exceeds one million USD ($ 1,000,000) ;

Any natural person who has an individual income in excess of two hundred thousand USD ($ 200,000), or joint income with that person's spouse over three hundred thousand USD ($ 300,000), in each of the two most recent years and who reasonably expects to reach the same income level in the current year;

Any trust with total assets over five million USD ($ 5,000,000), not formed for the specific purpose of acquiring the Common Stock, whose purchase is directed by a sophisticated person as described in Rule 506 (b) (2) (ii) of Regulation D; or

Any entity whose shareholders are accredited investors

To invest in this Offering, investors will need to first create an account and register on www.ceyron.io. Pursuant to Section 506 (c) of the Securities Act, evidence of accreditation status is required to invest. This can be achieved during the account creation process by completing the accreditation process in one of three general manners:

Accreditation based on Investor's Income

Accreditation based on Investor's Net Assets

Third-Party Verification Letter

Post Offering Securities Compliance and Transfer Restrictions

The CEY Tokens are offered and issued to persons other than U.S. Persons under the S Securities Act. Each Subscriber of CEY Tokens will be deemed to represent, warrant, and agree as follows:

Either it is: an "accredited investor" (as defined in Rule 501 of Regulation D under the Securities Act); or not a "U.S. Person "and is acquiring the CEY Tokens in an" offshore transaction "

If the Subscriber is an acquirer in a transaction occurring within United States, you acknowledge that until the Lock-Up Period lapses, you will not be allowed to offer, sell or transfer the CEY Tokens an

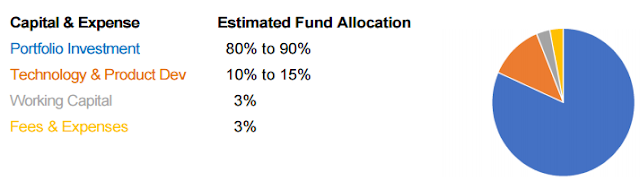

Use of Proceeds

The CEY Token funds will be used to provide funding for the following:

General Business Risks

In the event of an economic downturn, the company's business plan, ability to generate revenue, and overall solvency may be at risk. Early stage companies generally have a high risk, and the likelihood of failure of business, regardless of the overall business climate is possible.

Specific Business Risks

Investments in vehicles of this nature have various inherent risks, which could result in: (i) complete loss of investors capital, (iii) less than expected liquidity, among other things.

Credit Risk

There can be no assurance that the investment objective of the Fund will be achieved and that investors will not incur losses. To mitigate the risk of significant credit losses, CFL will take appropriate credit loss reserves, which will be accrued to each asset in accordance with our credit policy guidelines, which are consistent with typical financial institutions investing in similar credit assets.

Portfolio Risks

There is a risk that CFL may not achieve its targeted results. The coupon and yield to maturity of the CFL portfolio is critical to our ability to drive consistent dividends to token holders and continue to be able to reinvest in our portfolio, thus increasing the sustained value of the portfolio and token.

CFL may not be able to achieve its desired levels of leverage on its portfolio at the desired cost of debt. Accordingly, there is a risk that the net portfolio yield to investors may not be achieved. In that CFL, it intends to use senior secured leverage, the risk to the investor may be enhanced by the existence of a senior secured lien on the portfolio assets.

Whitepaper: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Facebook: https://web.facebook.com/Ceyron/

Twitter: https://twitter.com/CeyronICO

Instagram: https://www.instagram.com/cryronico/

Telegram: https://t.me/joinchat/HIFUXhLIUYQL88_NtoM4sA

Ann Tread BTT: https://bitcointalk.org/index.php?topic=2955746.0

Author : adifariz

Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1279352

ETH : 0x48CeC0d6baa75D069eA06A59D6Ed8916E94ef19A

Tidak ada komentar:

Posting Komentar